Take Control of Your Financial Future

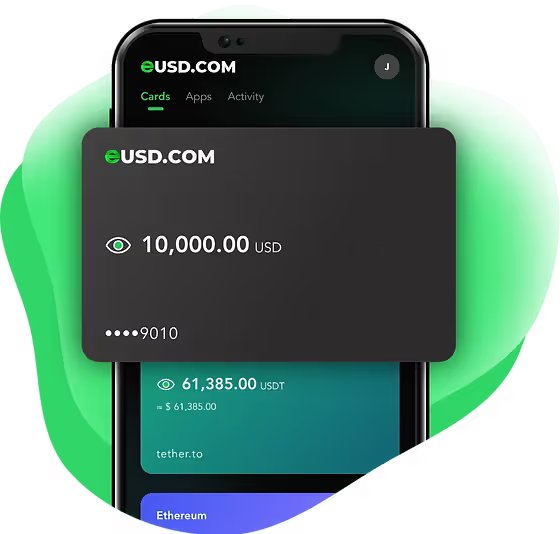

Revolutionise Your Money Management with eUSD.COM

Make your daily payments boarder-less easier, faster, and more affordable — saving you time, money, and stress

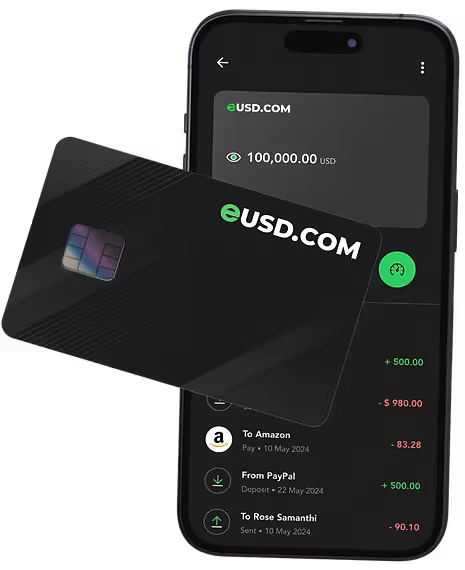

Get Your eUSD Card with First Year Annual Fee Waived!

Apply for your first digital or physical eUSD card today and enjoy a waived annual fee for the first year. Don’t miss out on this limited-time offer—apply now!

Pay Anytime Anywhere. Earn ePoints. Withdraw from ATM.

Explore Endless Possibilities with eUSD.COM

Convert More Earn More

More Than Just Rewards—A World of Benefits

Convert as You Need

Swap currencies instantly with just one click! Earn bonus ePoints on every exchange—maximize your gains with zero waste!

Unlock Exciting Rewards

The more you convert, the higher your level! Enjoy a waived annual fee on your eUSD card, exclusive memberships on major platforms, and exciting rewards such as the Switch, iPhone, and more.

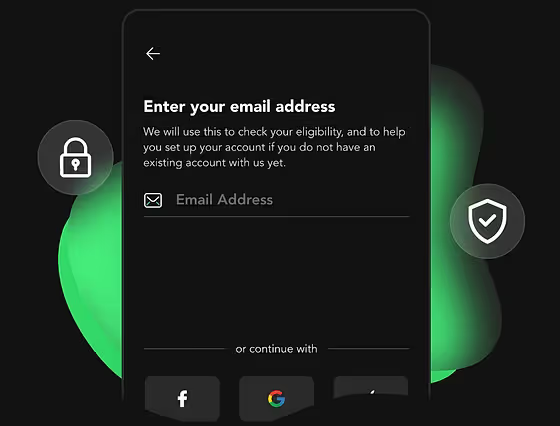

Onboard with Peace of Mind

Get started quickly with a hassle-free onboarding process, backed by top-tier security measures to protect your information and cards in eUSD.COM.

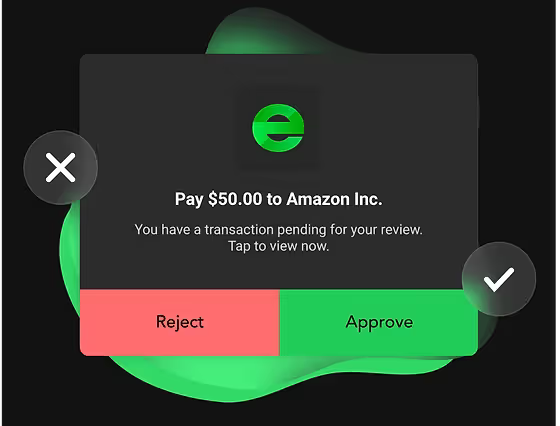

Manual Approval Payment via 3DS

An extra layer of security of 3DS helps prevent unauthorized purchases, ensuring that only legitimate transactions are processed.

Supports Online & Offline Payment

Our solution supports both online transactions for e-commerce, digital platforms, and mobile payments, as well as offline payments for in-store purchases, POS systems, and cashless transactions. We ensure secure, fast, and hassle-free payment processing to meet your needs.

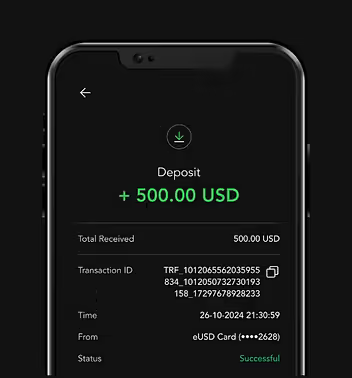

Know Where Your Money Goes

Get notification instantly right after you pay. Then set limit for your every spend per transaction, total spending of the day and month to better control your expenses budgets.

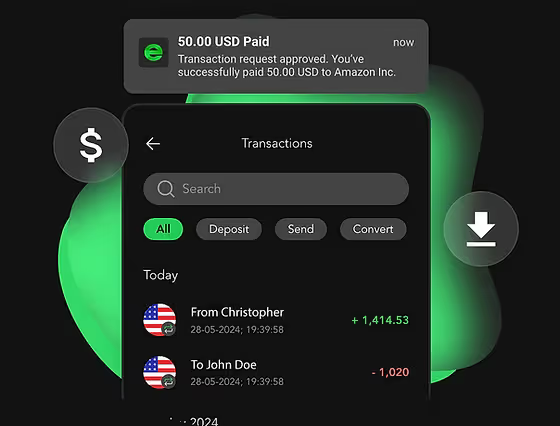

Transfer In A Breeze

Send Funds or Gifts to Friends

Send funds to your friends and family or surprise them with a gift! Our seamless and secure platform ensures instant transactions, allowing you to share assets effortlessly. Whether you’re supporting a loved one, or celebrating a special occasion, transferring assets has never been easier. Enjoy a hassle-free experience with zero hidden charges and complete peace of mind.

Download App

Smart Payment Partner

One Click Away to Manage Your Payment

Payment Approval via 3DS

An extra layer of security of 3DS helps prevent unauthorized purchases, ensuring that only legitimate transactions are processed.

Enhanced Card Security

Enjoy peace of mind with advanced security features like fraud protection and contactless payments.

Link Cards For Auto-Payment

Auto-payments helps manage recurring expenses more effectively by ensuring consistent payment, making it easier to track spending and budget.

Trusted by Global Partners

Our Partners